O’Connor Saved Tarrant County Clients $376.48 Million in Taxable Value

O’Connor discusses how we saved Tarrant County clients $376.48 million in taxable value.

FORT WORTH, TX, UNITED STATES, September 26, 2025 /EINPresswire.com/ --Very few things exhibit the saying “everything is bigger in Texas” than Tarrant County. Only beaten by Harris County in population, Tarrant County is one of the main pillars of the Dallas-Fort Worth metroplex. The county has not sat on historical laurels either and is quickly growing thanks to a diversifying population and economy. As the Dallas-Fort Worth area becomes one of the hottest places to work and live in the United States, things are sure to grow even more.

This unfortunately also extends to property taxes and values. Like the rest of Texas, these costs have been jumping every year. While exemptions have traditionally been used to stem the bleeding, property tax appeals are becoming more of the norm. While Tarrant County has been resistant to deploying these protests on a wide scale, each year sees a bit more of the taxpayers taking the fight to the Tarrant County Appraisal District (TAD). We at O’Connor are here to help and have partnered with taxpayers across the county in an effort to return things back to a sane level. In this article, we will explore how appeals have benefited taxpayers and how those that partnered with O’Connor did compared to the rest.

Homeowners That Joined O’Connor Saved 6.4% on Home Value

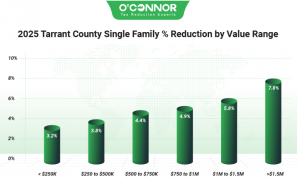

In 2024, studies showed that TAD had overvalued 44% of all homes in Tarrant County. A combination of appeals and better assessments dropped this to 19% in 2025, but the pang of doubt certainly remained in the minds of taxpayers. This is especially true after TAD ruled that home values had gone up 1.6%, leading to a record total value of $220.50 billion. This number did not stand for long, as appeals brought this down by 4.3%. The largest block of value was homes worth between $250,000 and $500,000, which accounted for $107.44 billion. These were followed by homes worth between $500,000 and $750,000, which totaled $33.56 billion after reductions. Homes below $250,000 achieved a cut of 3.2%, totaling $30.55 billion. Tarrant County homeowners that partnered with O’Connor saw a value reduction of 6.4%, which resulted in a total drop of $222.61 million.

Despite its size and value, Tarrant County is a place for working families and the middle class at heart. This can be seen in the wide variety of modest homes in the county. Most home value was reserved in residential properties 2,000 to 3,999 square feet, totaling $99.07 billion after a sizeable reduction of 4.3%. Homes under 2,000 square feet were in the No. 2 spot with $83.22 billion after appeals reductions resulted in a drop of 3.5%. After a significant decrease of 5.9%, homes between 4,000 and 5,999 square feet totaled $21.53 billion. Even though they were small on the balance sheet, the largest homes still saw a solid decrease of 10.7%.

When looked at by age of construction, the biggest portion of Tarrant County home value was built during the housing boom between 2001 and 2020. $79.22 billion was created in this timeframe, an amount settled on after appeals shaved the total down by 4.7%. This was closely followed by those built from 1981 to 2000, which were responsible for $60.79 billion after protests lowered the amount by 4.1%. After that, value was more evenly distributed between timeframes. 12.2% of all value was built before 1960, while 6.6% was the result of new construction. The category of “other” is from raw land and homes still under construction.

Commercial Property Value Slashed 15.45% by O’Connor

TAD issued a massive increase in commercial value to start 2025, with an overall jump of 25%. This brought the total to a massive $73.93 billion. Unsurprisingly, business owners of all stripes launched a blistering barrage of property tax protests. These managed to claw back around 11.7% of the total, a great result for Tarrant County. $50.25 billion in value came from commercial properties worth over $1.5 million, after a great reduction of 12.9%. While only accounting for a fraction of the whole, all other categories managed to get solid wins. Those worth between $1 million and $1.5 million cut 8.8% in value to reach $10.35 billion, while business real estate worth between $500,000 and $1 million got a reduction of 6% to fall to $2.35 billion. Clients of O’Connor were able to get an overall reduction of 15.4%, while owners of properties worth over $1.5 million managed a strong reduction of 16%. Our clients managed to save $153.87 million on their taxable value when it came to commercial properties as a whole.

In keeping with the majority of Texas, the largest commercial asset in Tarrant County was apartments, which combined for $36.36 billion after a cut of 11.6% thanks to appeals. Offices were a very distant second with $10.10 billion after a decrease of 9.7%. Retail was not far behind in value with $8.31 billion in value after a large decrease of 13.1%. The fastest-growing property type, hotels, also got the biggest cut with 19.9%. Raw, undeveloped land even got some good appeal results, falling 8.1% to $4.80 billion.

The 2001 to 2020 construction boom was the primary source of commercial value, with 36.1% of it being built in that timeframe, which translated to $23.55 billion in 2025. While these key properties received a cutback of 10.5%, properties built between 1981 and 2000 got a reduction of 12.4%, leaving a combined total of $18.80 billion. The largest reduction was reserved for the third place properties that were constructed from 1961 to 1980 with 15.7%, which meant a total of $9.07 billion. New construction has been climbing the charts, as expected, but was partially slowed by a solid cut of 9.5%. The “other” category was reserved for raw land and business real estate currently under development.

O’Connor Reduced Tarrant County Office Value by 12.7%

Before appeals, Tarrant County office buildings increased to $11.18 billion in value, a new record. A concerted protest effort managed to get that peeled back by 9.7%. 44% of all office value was constructed during the 2001 to 2020 boom, which is somewhat rare as offices tend to be older. This resulted in a total of $4.50 billion after a decrease of 7.9% thanks to protests. This was followed by a cut of 11.9% for those built between 1981 and 2000, which resulted in a final total of $3.14 billion. O’Connor was able to land our clients an even larger reduction than the county number, cutting 12.7% from the total. When all was said and done, our customers managed a savings of $16.29 million.

TAD divided offices into three subtypes for measurement purposes. The largest were low-rise offices, which were valued at $4.62 million, after a reduction of 8.6%. These were followed by high-rise buildings, which saw the No. 1 decrease of 13.4%, which translated into a total of $3.13 billion. Medical offices reached $2.35 after a decrease of 6.8%.

Retail Owners Get a Reduction of 16%

Retail is the lifeblood form of business in most communities, and it was protected by property tax appeals to great effect in 2025, with an overall reduction of 13.1%. When looked at by age of construction, the largest contributor to value was retail businesses built between 1981 and 2000. These contributed $3.01 billion in value, after being reduced 13.3%. These were followed closely by properties constructed during the boom period of 2001 to 2020, which resulted in a total of $2.72 billion after a reduction of 10.8%. The No. 3 spot was reserved for those built between 1961 and 1980, with a total of $1.32 billion after a 16.4% cut. We at O’Connor were able to beat the county number with an overall value slash of 16%, resulting in a total savings of $19.38 million.

While retail spaces come in a myriad of forms, TAD broke them down into only four. Neighborhood shopping centers had the most value at $3.83 billion, which was achieved after a protest reduction of 11%. Community shopping centers were next, landing a big reduction of 12.8% to total $21.10 billion. Single-occupancy stores did well, falling 10.4% to $1.54 billion. Surprisingly, the largest reduction in percentage was a giant 26.2% for shopping malls, bringing their combined value to $830.78 million.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.